On This Page[Hide][Show]

Prudential Insurance Company of America (Prudential) is a division of Prudential Financial. It is one of the largest disability insurance companies in the United States, offering group disability and life insurance. Insurance companies like Prudential prioritize their profits over the well-being of their policyholders. Unfortunately, this can lead to unfair Prudential long-term disability denials that leave claimants in difficult situations.

Prudential’s history of unfair practices and denials of legitimate claims has led to nationwide investigations. If Prudential has denied your long-term disability claim, you need to understand your rights and explore your legal options. By seeking the assistance of experienced legal professionals, such as the Ortiz Law Firm, you can fight against Prudential’s decision and pursue the benefits you rightfully deserve. Don’t take “no” for an answer—take action now to protect your financial stability. We will not let Prudential intimidate you.

Prudential’s Role In Long-Term Disability Claims

Prudential plays an important role as one of the leading insurance providers. Prudential acts as a long-term disability benefits administrator, processing and managing the claims submitted by policyholders. Their goal is to verify the accuracy of the information provided and ensure that the disability meets the requirements of the policy.

The claim review process may include:

- Reviewing medical records

- Consulting with independent medical experts

- Conducting interviews or surveillance

Understanding Prudential Disability Denials

Receiving a denial of your long-term disability claim from Prudential can be devastating. However, it is important to understand the reason for the denial, which can help you navigate the appeal process more effectively.

Prudential often denies long-term disability insurance claims for one of several main reasons:

- Insufficient medical evidence is a common reason for denial. Prudential requires detailed and objective documentation of the claimant’s medical condition and limitations.

- Failure to meet the policy’s definition of disability may result in a denial. Prudential evaluates the claimant’s ability to perform their job and may deny claims if it believes the individual can still work.

- Incomplete or inaccurate claim forms and missing documentation can also result in a denial. It is critical that all required information is submitted accurately and promptly.

- Prudential uses a team of doctors, examiners, and experts to evaluate your disability, even if you provide medical evidence to support your claim. These professionals may be biased toward Prudential, and their findings could potentially harm or work against your claim.

- Prudential may hire investigators to observe and document your daily activities through video surveillance so that they can use the footage to challenge the validity of your disability claim.

- Social media often portrays the best aspects of our lives while concealing our challenges. Prudential may scrutinize your online presence to find any evidence that contradicts your disability claim.

- Pre-existing conditions or policy exclusions may be grounds for denial. Prudential may deny claims if the disabling condition is pre-existing or excluded from coverage.

If Prudential has denied your disability claim, contact us to schedule a free case evaluation. We work closely with our clients to develop their claim files. We will review your claim to determine why it was denied and what evidence is most important for your appeal.

Top Reasons Why Prudential Denies Long-Term Disability Claims

Recognizing Bad Faith In Disability Insurance Claims

If Prudential denies a valid disability claim without proper justification, it may be considered a violation of the principle of good faith and fair dealing, known as acting in bad faith. Disability insurance companies must act in good faith when handling claims and must not unreasonably deny valid claims.

The principle of good faith means that insurance companies should thoroughly investigate claims thoroughly, fairly evaluate the medical evidence presented, and make decisions based on the merits of the claim. Denying a claim without a proper and valid reason may constitute a bad faith denial.

When Prudential unfairly denies a disability claim, it violates the trust between the policyholder and the insurance company. It violates the principles of fairness and accountability. Policyholders can get the benefits they deserve by challenging these denials.

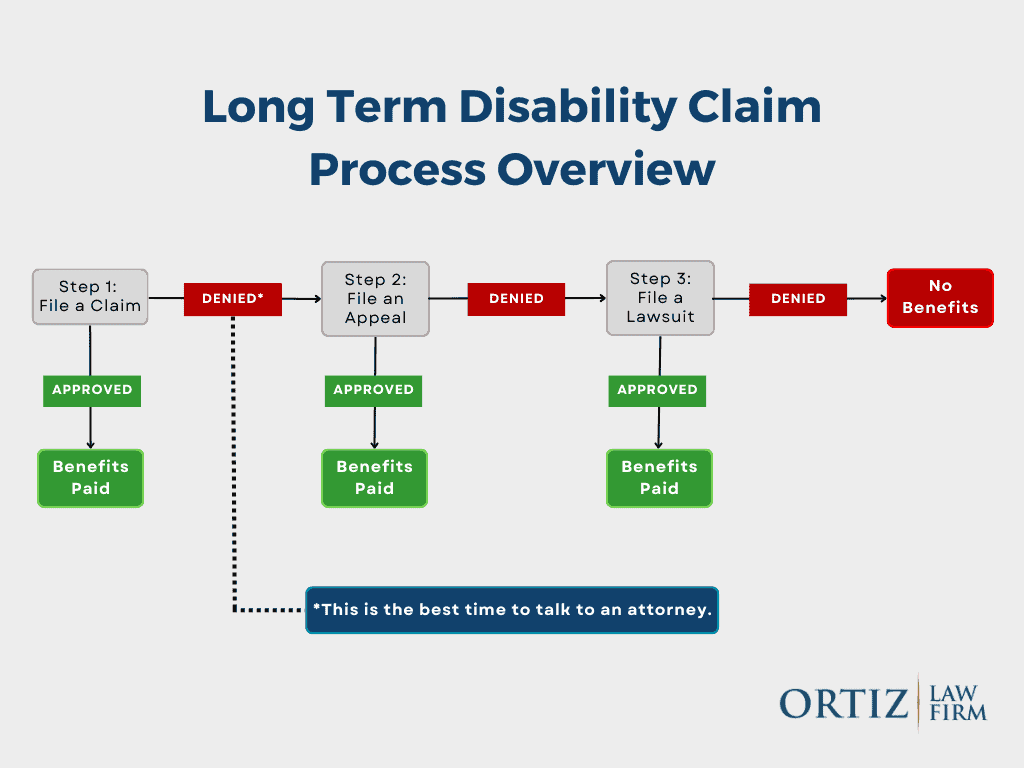

What to Do After a Prudential Long-Term Disability Denial

If Prudential has denied your long-term disability claim, do not give up. It can be a frustrating and overwhelming experience, but it’s important to remember that you have options and rights. Understanding the specific laws that apply to your case can provide valuable insight into the next steps you should take.

ERISA Law

One aspect of disability insurance that comes into play when your claim is denied is ERISA law. The Employee Retirement Income Security Act, or ERISA, is a federal law. It governs most employer-sponsored disability insurance policies. Under ERISA, there are specific procedures and deadlines that you must follow to appeal the denial of your claim.

It’s important to review your policy and consult with a qualified ERISA attorney to make sure you’re complying with these requirements. Navigating the complexities of ERISA can be challenging, but having an expert on your side can greatly increase your chances of successfully challenging the denial.

What If ERISA Does Not Apply to My Claim?

If you have an individual disability income policy, your claim may be exempt from ERISA and governed by state law. Claims by church or government employees may also be exempt from ERISA law. If so, you may not have to file an appeal before filing a lawsuit.

State laws regarding disability insurance claims and appeals can vary, so it’s important to research and understand your specific state’s regulations. Consulting with a knowledgeable disability insurance attorney who understands state law can provide valuable guidance tailored to your situation.

Whether you have a group or individual policy, our experienced disability attorneys are here to help. We will protect your interests from Prudential’s bad faith while fighting to overturn your denial. We are experienced in disability law and will ensure that your LTD insurance carrier acts in good faith.

“I was fighting a long-term disability company whose policy I had bought and who refused to pay any of my benefits after I became disabled. Nick agreed to take my case and though there were many hoops he had to jump through, he never gave up. I will always be grateful to Nick and his staff for all the work they did on my behalf.” – Teacher with a Denied Disability Claim

How to Appeal a Denied Claim

When faced with a Prudential long-term disability claim denial, the first step is to file an appeal. The appeal process allows you to present additional evidence, address discrepancies, and make a strong case for why your claim should be approved. Here are some important steps to follow when filing an appeal:

- Understand the Denial Letter: Carefully review Prudential’s denial letter to understand why Prudential denied your claim. The specific reasons for the denial will help you identify the areas to focus on during the appeal process.

- Gather Supporting Documentation: Gather all relevant medical records, test results, physician statements, and any other evidence that supports your disability claim. Make sure that these documents demonstrate the severity of your condition and its effect on your ability to work. If ERISA applies to your claim, this may be your only opportunity to submit additional evidence.

- Write a Strong Appeal Letter: Write a strong appeal letter that addresses each reason for denial listed in the letter. You or your attorney should explain why Prudential should reverse its denial and provide detailed evidence to support your arguments.

- Submit Your Appeal Before the Deadline: Be aware of the deadline for submitting your appeal. If you miss the deadline, you may lose your right to appeal. Under ERISA, claimants generally have 180 days after they receive notice that Prudential has denied their claim to file an appeal.

RELATED POST: LTD Appeal Guide: How to Appeal a Long-Term Disability Denial

Additional Evidence to Support Your Appeal

Additional evidence you can gather to support your appeal to Prudential includes:

- Additional Medical Examinations: If Prudential denied your claim due to insufficient medical evidence, it would be beneficial to undergo additional examinations or consult with other specialists to provide further evidence of your disability.

- Reports from Your Treating Physician: Medical records may not always fully document the extent of your medical condition. A written report from your doctor can help highlight symptoms of your impairment that your records may not fully explain. Your doctor can also describe how these symptoms affect your daily functioning. It is important to be open with your doctor about your condition so that they do not miss any details about your symptoms.

- Opinions from Vocational Experts: Prudential may have denied your claim because it concluded that you can still perform the essential duties of your job or a similar job if your policy uses the “any occupation” definition. Prudential may have based its decision on the opinion of an expert they hired, so it is important to get an unbiased opinion for your appeal. Finding outside vocational experts who can evaluate your occupation without bias can help determine whether you are truly unable to perform the required duties.

- Testimony from Family, Friends, and Co-workers: Testimony from people close to you can provide insight into how your condition affects your daily life. They may have observed firsthand how your impairment affects your personal life and work performance in ways that doctors may not have. Such testimony can strengthen your case by providing additional evidence of how your disability affects your home life and impairs your ability to work.

Considering a Prudential Lawsuit

Sometimes filing an appeal is not be enough to secure the long-term disability benefits you deserve. If you face persistent denials or unreasonable tactics from the insurance company, legal action against Prudential may be necessary. Here are some key points to consider if you are considering filing a lawsuit:

- Assess the Strength of Your Case: Consult with an experienced long-term disability attorney to evaluate the strength of your case. They can help you determine whether you have a valid claim and whether filing a lawsuit is in your best interest.

- Determine Any Time Limits: There is usually a statute of limitations for filing a lawsuit. Each policy has different timeframes within which you must file your claim, so it’s important to be aware of the deadlines to avoid losing your right to pursue legal recourse.

- Build a Strong Case: Work closely with your attorney to gather and organize all necessary evidence, including medical records, employment history, and any correspondence with Prudential. This evidence will be critical in building a strong case against Prudential.

- Seek Legal Representation: Hire an experienced disability insurance attorney who specializes in long-term disability claims. If ERISA applies to your claim, make sure they are familiar with ERISA. They can guide you through the legal process, negotiate, and advocate for your rights.

Remember to consult with an experienced long-term disability attorney who can provide personalized advice based on your unique situation.

Federal Court Cases Against Prudential

Although we were not involved in the federal court cases listed below, we have summarized them to help claimants better understand how disability law is interpreted and how the Court decides such claims.

- Paquin v. Prudential – Insurer Wrongly Disregarded Opinions of Treating Physicians

- Seese v. Prudential – Court Rules ADA Claim Against Prudential Must Be Dismissed

- Nieves v. Prudential – Prudential Failed to Provide a Full and Fair Review

- Maher v. Prudential – Court Rules LTD Denial Was Not Arbitrary & Capricious

- Doe v. Prudential – Court Rules That The Mental Illness Limitation Doesn’t Apply

- Cowern v. Prudential – Vocational Expert Not Permitted to Consider All Records

- Ampe v. Prudential – Engineer’s Case Remanded For Further Consideration

How an Attorney Can Help You Fight a Long-Term Disability Denial

Having a long-term disability claim denied can be a frustrating and overwhelming experience. In this situation, seeking the assistance of a Prudential disability insurance claim denial lawyer can prove invaluable. A knowledgeable disability insurance attorney can provide guidance and support throughout the appeals process and help navigate the legal actions necessary to combat a denial of benefits.

Having a legal professional on your side means having someone who understands the complexities of disability law and can navigate the intricate procedures involved in appealing a denial. They can gather and review all the necessary evidence, ensuring that your medical records and relevant documentation are up to date and presented in the best light.

In addition, legal representation serves as a strong advocate for your rights. Your attorney can communicate directly with Prudential and use their legal knowledge to hold the insurance company accountable for any unfair denials. An attorney’s expertise can help level the playing field and protect your rights.

Filing an Administrative Appeal

When faced with a denied LTD claim, one of the first steps is to file an appeal. This crucial stage allows you to present additional evidence and arguments in support of your claim. However, navigating the complex appeals process can be challenging, especially when dealing with insurance companies and their legal teams.

A long-term disability attorney can provide the expertise you need to strengthen your appeal. They can analyze the reasons for the denial, review your medical records, gather supporting evidence, and craft persuasive arguments to present to the insurance company. With their help, you can have a comprehensive and well-prepared appeal that increases your chances of success.

“Ortiz Law Firm has done an amazing job keeping me updated on every step of the process, which helped relieve some of my stress. It was also tremendously helpful to no longer have to personally deal with the anxiety created by the constant bombardment of arguments and requests from the insurance company.” – Analyst with a Denied Disability Claim

Navigating Lawsuits Against Prudential

The litigation process is where the expertise of a Prudential disability claim denial lawyer really shines. They will have experience with the applicable laws and regulations, such as ERISA. They will present compelling arguments and work tirelessly to secure a favorable outcome.

By enlisting the help of a Prudential Disability Insurance Claim Denial Lawyer to protect your rights, you can level the playing field throughout the appeals process and potential legal action against Prudential.

A Long-Term Disability Lawyer at the Ortiz Law Firm Can Help with Your Claim

If Prudential has denied your long-term disability claim, you need to understand that you have options. You don’t have to face this challenge alone. The Ortiz Law Firm is dedicated to fighting for your rights and getting you the benefits you deserve.

Remember, overturning a denied LTD claim can be complex and challenging. Seeking legal assistance early on can provide you with the knowledge, guidance, and support you need to navigate this complicated process and increase your chances of a successful outcome.

We have a “No Recovery, Zero Fee Guarantee.” This means our clients only pay a fee when disability benefits are recovered.

Our Case Results

Don’t accept a denial without a fight. We have a proven track record of recovering millions in benefits for clients with denied disability claims. Below are some of the Prudential disability claims we have brought to a favorable resolution.

- Successful Claim for RN with Migraines: A registered nurse with migraine headaches had their long-term disability claim initially denied by Prudential due to a lack of objective medical evidence and reliance on the claimant’s self-reported symptoms. Despite providing updated medical evidence in our appeal, the denial was upheld. We filed an additional appeal, and Prudential ultimately found the claimant eligible for benefits and reinstated the claim.

- Mental Health and Insomnia Claim Approved: An account executive with depression, PTSD, anxiety, and insomnia had their long-term disability claim denied by Prudential. After two appeals, a peer review, and an independent medical evaluation (IME), the claimant was found to be disabled.

Schedule a Free Case Review

Don’t let Prudential’s denial stand in the way of your rightful benefits. Take action today to protect your financial stability and secure the compensation you deserve. Call (888) 321-8131 or fill out our contact form to schedule a free case review.

Frequently Asked Questions

Why would Prudential deny a claim for long-term disability?

Prudential may deny a long-term disability claim for a number of reasons, including lack of medical evidence, failure to meet the definition of disability, insufficient documentation, or a determination that the claimant can perform their job duties.

How do I appeal a Prudential long-term disability claim denial?

To appeal a Prudential long-term disability denial, you must follow the specific instructions outlined in your denial letter. This usually includes submitting additional supporting documentation, medical records, and any other relevant information to address the reasons for the denial.

What are my options if Prudential denies my claim?

If Prudential denies your appeal, you may have the option of filing a lawsuit against them. It is advisable to consult with an attorney experienced in long-term disability insurance claims to evaluate your legal options and guide you through the process.

Can I hire an attorney to help me with my Prudential long-term disability denial?

You can hire an attorney to help you with your Prudential long-term disability denial. An attorney who specializes in disability claims can provide valuable advice, negotiate with Prudential on your behalf, and represent your interests during the appeals process or in a potential lawsuit.

How long does it take to resolve a Prudential long-term disability denial?

The timeline for resolving a Prudential long-term disability denial can vary depending on several factors, including the complexity of your case, the availability of supporting evidence, and the efficiency of the appeals process. It is important to be patient and work closely with your attorney to ensure the best possible outcome.

Will hiring an attorney increase my chances of overturning a Prudential long-term disability denial?

While hiring an attorney does not guarantee a successful outcome, having legal representation can significantly improve your chances of overturning a Prudential long-term disability denial. An experienced attorney can navigate the complex appeals process, gather the necessary evidence, and develop a strong case on your behalf.

Are there time limits for appealing a Prudential long-term disability denial?

Yes, there are usually specific time limits within which you must file an appeal of a Prudential long-term disability denial. It is important to carefully review the denial letter and meet the stated deadline. Failure to meet the deadline may result in the loss of your right to appeal.

How much will it cost to hire an attorney for my Prudential long-term disability denial?

The cost of hiring an attorney for your Prudential long-term disability denial can vary depending on the attorney’s fee structure. In most cases, disability lawyers work on a contingency fee basis. This means that they are only paid if they successfully obtain benefits for you.