On This Page[Hide][Show]

Long-term disability insurance is offered to help support you as a wage replacement if you’re sick or injured and unable to work. Unfortunately, what should be a relatively straightforward claim process is anything but. Despite paying your premiums for months, years, or even decades, your insurance company may unfairly deny your disability insurance claim, leaving you without the steady income replacement you expected.

What Is Long-Term Disability Insurance?

Long-term disability (“LTD”) benefits provide vital income protection to individuals beginning a few weeks to a few months after the onset of a disabling medical condition. LTD benefits typically kick in once the short-term disability benefit period ends.

As with short-term disability insurance benefits, LTD benefits are designed to replace a specific percentage of your pre-disability income starting a few weeks or months after the onset of a disabling illness or accident. Policies typically provide coverage until retirement age, which is usually defined as age 65 in the policy but may also be specifically defined in the policy.

You can typically purchase long-term disability insurance benefits from an insurance agent or through your employer. Some benefits you might obtain include:

- Bi-weekly or monthly benefit payments, which will pay you a portion of your pre-disability earnings on a bi-weekly or monthly basis for the term length of your policy and

- Comprehensive Rehabilitation Program benefits can provide incentives related to vocational (job) rehabilitation, dependent (child) care, workplace modifications, and more.

What Does My Policy Cover?

Long-term disability is designed to cover a variety of illnesses and ailments. Some people think that long-term disability only covers injuries that happen on the job. However, although on-the-job injuries may be covered, more than 95% of long-term disability claims are believed to be non-work-related.

For example, injuries suffered outside of work, cancer, auto-immune disorders, mental illness, chronic illnesses, neurological disorders, and degenerative diseases are likely to be covered by a long-term disability policy. This list is incomplete, but it gives examples of conditions that may qualify for benefits.

Don’t Believe These Myths About Long-Term Disability Claims

Here are some myths you may have heard concerning the long-term disability claims process and insurance companies:

- The best way to convince the insurance company that you cannot work at your secretarial job is for you to write a 60-page letter describing your medical condition in exquisite detail.

- Any lawyer can help you with your ERISA long-term disability claim.

- You should hold back your best evidence for trial.

- Your doctors will come to trial to testify for and convince the judge that you are disabled.

- You will be allowed to testify at trial if your case is filed.

- If your doctors write that you are disabled then you should automatically win your case.

- The insurance company’s appeal process is fair and unbiased.

- You are on a level playing field with the insurance company.

- If your employer says you’re too disabled to work, your insurance company will automatically pay benefits.

If you believe anything that’s listed in this list of myths, then the insurance company has a huge advantage over you.

The ERISA Claims Process

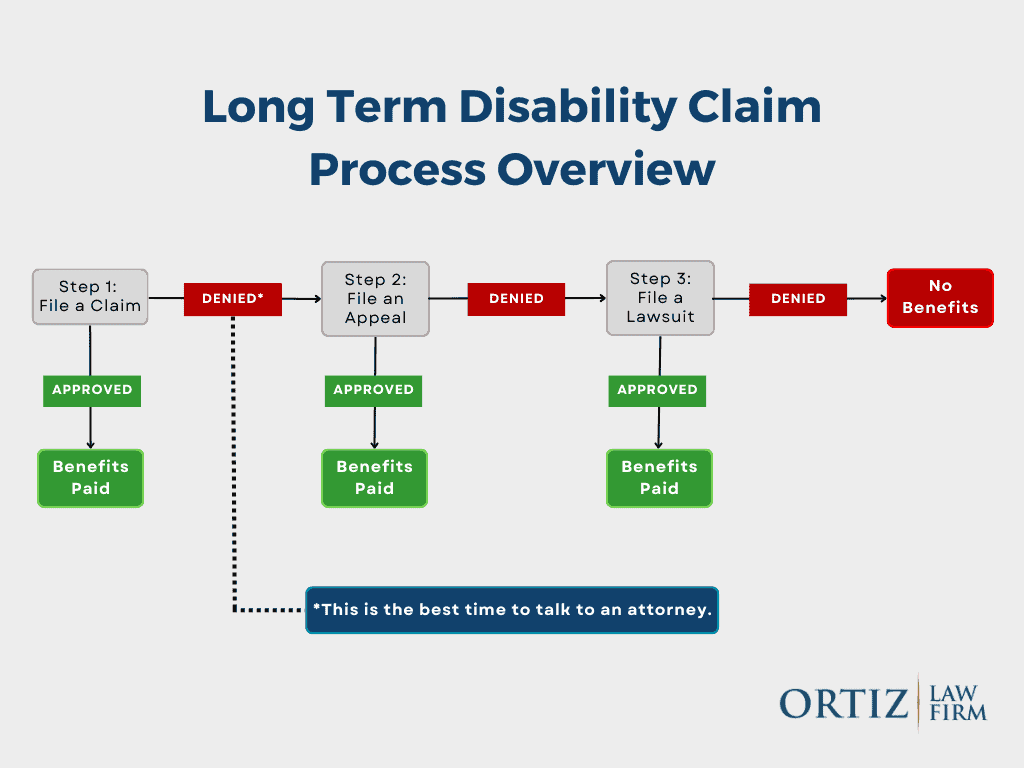

Here, we look at a general overview of the claims process and appeals procedures in ERISA disability claims.

- The first thing you should do is contact your employer’s human resources department for your disability insurance plan’s specific procedure details. Do not simply make this request verbally. Make the request in writing. Your disability insurance company should send you a written procedure or application for free.

- Make sure you note any deadlines to file the claim.

- File the claim before the deadline.

- The insurance company may request additional information to decide the claim. The insurer will advise you of any deadlines to submit the additional information. Remember, it is your burden to prove you have a disability. It is not the insurance company’s burden to prove you are not disabled. Therefore, provide whatever documentation necessary to satisfy your “burden of proof.”

- If you are approved, then you will start drawing your benefits. If you are denied, your insurance company should advise you of its decision in writing. You have the right to appeal the decision if you receive a denial.

- Make sure to note any deadlines to file your appeal. The deadline is likely in the insurance company’s denial letter.

- File your formal notice of appeal within the time limits, typically 180 days.

- The insurance company will again review your appeal and issue a new decision. If your claim is approved, you will begin to draw your benefits and any past-due benefits. The insurance company should advise you of your appeal rights in the denial letter if you are denied.

- Once you have exhausted all your administrative appeals, you can file a lawsuit in federal court, challenging the insurance company’s wrongful denial of your claim.

Sick or Injured But Have Not Yet Filed a Claim

Complex claim paperwork is the last thing on your mind when you are struggling with sickness, illness, or an injury. While you may have a long-term disability policy, you may not know what benefits the insurance contract affords, what the policy covers, how to file a claim, the time limits to file a claim, and what you need to do next.

This is where the Ortiz Law Firm can help. Our free book on long-term disability claims can help you recover the benefits you may be entitled to. Topics in the book include:

- Understanding Your Policy;

- Common Mistakes in Filing a Claim; and

- When to Seek Legal Advice From an Attorney.

FREE RESOURCE: Long-Term Disability Insurance Claim Guide and Toolkit.

Applied For Benefits and Waiting On a Decision

If you’ve applied for long-term disability benefits and you still haven’t heard a response from your disability insurance carrier, you should contact them for the status of your claim. Intentionally delaying a claim decision is one way some insurers demonstrate bad faith in failing to honor their contract with you. Without an official denial, you’re unable to appeal. However, you may have the right to go right to court under certain circumstances

Applied For Benefits and Denied, But Appeals Are Still Available

Too often, legitimate long-term disability claims are denied or wrongfully terminated because insurance companies look for every possible legal and technical reason to deny or cut off a valid claim. In most circumstances, if your initial application is denied, you can file one or more appeals with the insurance company. If you previously received LTD benefits and the insurance company wrongfully terminated your benefits, you also have the right to appeal the cessation of benefits.

If you have been denied coverage for benefits, you should make sure you appeal the decision using the administrative process outlined by your insurance company. However, you should also remember that appeals are not always required before filing a lawsuit in certain circumstances. That’s why you should consult with an experienced LTD attorney to discuss your legal rights.

FREE RESOURCE: Long-Term Disability Insurance Appeal Guide

Applied For Benefits and Denied, But All Appeals Have Been Exhausted

At some point, no more appeals will be available to you. In such an event, the insurance company will tell you that you have “exhausted” all of your administrative appeals. You then have the right to sue the insurance company in State or Federal Court.

Working with a Long-Term Disability Attorney

Nick Ortiz is an experienced long-term disability attorney. We here at the Ortiz Law Firm have assisted claimants in filing internal “administrative” appeals with the insurance company to maximize the chances that your LTD claim will be approved or reinstated since 2012.

We have a “Zero Fee Guarantee,” which means our clients only pay an attorney fee when disability benefits are recovered. We handle long-term disability claims at every level of appeal, including:

- The first administrative appeal;

- The second administrative appeal;

- All “optional” levels of appeal;

- Litigation claims in state court (for individual disability insurance claims, church plans, and government employees) and

- Litigation claims in federal court for ERISA claims.

Call us today at (888) 321-8131 to schedule a free, no-obligation disability case review.

What To Do If Your Long-Term Disability Claim Has Been Denied

What To Do If Your Long-Term Disability Claim Has Been Denied