Patients with osteoporosis may be unable to work because of their disease and its related complications. Patients who find themselves unable to work because of their osteoporosis may qualify for long-term disability (LTD) benefits. The insurance company will review their claim to see if they qualify under the conditions of that plan.

What Is Osteoporosis?

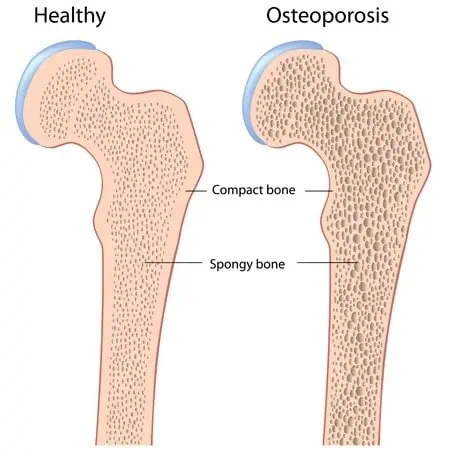

Osteoporosis means “porous bone”; it is a condition that causes bones to become brittle and very weak. It is a disease characterized by low bone mass and structural deterioration of bone tissue, leading to fragile bones and an increased risk of broken bones and hip, spine, and wrist fractures.

Both men and women are affected by osteoporosis. In the United States, more than 40 million people either already have osteoporosis or are at high risk for the disease due to low bone mass.

Unfortunately, osteoporosis does not usually cause noticeable problems until the condition has already developed to the advanced stage. Osteoporosis occurs when the body no longer replenishes bone tissue as quickly as it loses it. Testing for osteoporosis is done primarily via a bone density test, which measures the strength of bone in the body. Eventually, it will cause back pain, joint pain, height loss, stooped posture, and fractures, particularly of the back vertebra, hips, or wrists. In the most severe cases, it can be quite debilitating.

However, a long-term disability insurance company will not typically grant you disability benefits based solely on osteoporosis. The carrier may find you eligible for benefits if you suffer from a related disorder or if the combined effects of all your medical conditions result in severe limitations. To qualify for long-term disability insurance benefits, you must prove that your activities of daily living (ADLs) and residual functional capacity (RFC) are so affected by your condition that you are unable to maintain gainful employment

Qualifying for Long-Term Disability Benefits with Osteoporosis

Your likelihood of qualifying for LTD benefits and being approved for disability benefits will depend entirely on the evidence submitted supporting your claim. The record supporting your claim includes the information in your medical records, including the statements and treatment notes obtained from your treating physicians (doctors who have treated you and are therefore qualified to comment on your condition and prognosis). It also includes admit/discharge summaries from hospital stays, reports of imaging studies (such as x-rays, MRIs, and CT scans), lab panels (i.e., bloodwork), and physical therapy progress reports.

The important thing to remember is that long-term disability insurance companies do not award benefits based on simply having a condition. Instead, they will base an approval or denial on how much a medical condition impairs your ability to work. Your functional limitations must be severe enough to keep you from being able to perform full-time work activities.

Why Are So Many LTD Cases Denied at the Disability Application Level and Appeal?

Long-term disability claims are most often denied or terminated (cut-off) because there is insufficient evidence of the claimant’s functional limitations. Most insurance companies will provide you with an Attending Physician Statement to be filled out by your treating physician. The insurance company does not have to request the form from your doctor. Moreover, at the end of the day, it is the claimant’s “burden of proof” to prove disability. You (or your attorney) should make the greatest effort to have the APS filled out.

It is not enough for a doctor to make a blanket statement that you are disabled. The physician must state the specific ways and how much you are functionally limited. For this reason, many attorneys request that the physician fill out and sign a customized medical source statement to identify the limitations of the claimant’s specific medical impairments. Medical source statements supported by the underlying medical records may distinguish between a long-term disability claim being approved or denied.

Medically Qualifying for LTD Benefits with Osteoporosis

The insurance company claims adjuster will review your ADLs through an RFC analysis. Under an “own occupation” disability standard, the claims adjuster must conclude that you cannot perform your occupation.

Note: Each insurance policy defines “own occupation,” so you must determine how your insurance policy defines that term.

Under an “any occupation” disability standard, the adjuster must conclude that you are so severely affected by your osteoporosis that you cannot reasonably be expected to work in any job for which you would otherwise be qualified.

Legal Help with Your Claim

Strong medical evidence is the key to any disability claim. We work to fully document all of the effects of your osteoporosis and the severity of your subjective symptoms. You should strongly consider seeking the assistance of an experienced long-term disability to assist you in the disability claims process.

The Ortiz Law Firm has successfully represented people in disability cases across the United States, and we have represented claimants in claims with New York Life, Hartford, Lincoln, MetLife, Prudential, Reliance Standard, Unum, and a variety of other disability insurance companies. If you would like to talk to an experienced disability lawyer about your osteoporosis and its impact on your ability to work, call us at (888) 321-8131. We would be happy to evaluate your case and discuss how to help you through the appeal process.