Table of Contents

Are you struggling to get the long-term disability (LTD) benefits you deserve? A disability attorney can help. Nick Ortiz is a national Long-Term Disability & ERISA Attorney based in Pensacola, Florida.

Having handled long-term disability claims since 2005, Nick Ortiz and the experienced legal team at the Ortiz Law Firm understand the complexities and challenges claimants face when dealing with an insurance company and know how frustrating it is to fight with your disability insurance company to obtain your rightful benefits.

We believe everyone deserves access to the benefits they are entitled to. If your insurance carrier has wrongfully denied or terminated your long-term disability benefits, we offer a free case review. Call us at (888) 321-8131 or click the button below to schedule your case review today.

Get a Free Case ReviewLong-Term Disability Claim Overview

Long-term disability benefits are designed to provide ongoing financial support to employees who cannot work due to a severe illness or injury. These benefits are typically provided through employer-sponsored disability insurance plans or individual disability insurance policies. LTD benefits may be paid for several years or until the claimant reaches retirement age if they continue to meet the requirements outlined in the disability insurance policy.

What Conditions Qualify for Long-Term Claim Process Disability?

There are a variety of different medical conditions that can qualify for LTD benefits. The top 5 reasons behind long-term disability claims are:

- Muscle/Bone Disorders

- Accidents

- Mental Disorders

- Cancer

- Cardiovascular Disorders

What to Expect During the Long-Term Disability Application Process

The long-term disability application process can be complex and time-consuming. You can expect to:

- Gather and organize medical and financial documentation to support your claim.

- Submit your claim to your employer or insurance company.

- Wait for a decision on your claim, which can take several months or longer.

Tips for Increasing Your Chances of Getting Approved for LTD Benefits

Some tips for increasing the chances that your claim for disability benefits will be approved include:

- Provide thorough and accurate medical documentation to support your claim

- Be persistent and follow up regularly on your claim status

- Seek legal assistance when necessary

- Understand and follow the application requirements and deadlines

Common Challenges in Long-Term Disability Claims

Dealing with an insurance company can be daunting. Some of the most common challenges include:

- Meeting the Definition of Disability: Insurance companies often have strict definitions of disability, making it challenging for claimants to qualify for benefits.

- Meeting Deadlines: There are often strict deadlines for filing claims and providing supporting documentation, which can be difficult for individuals dealing with a long-term illness or injury.

- Medical Evidence: Insurance companies require medical evidence to support a disability claim, and gathering all the necessary documentation can be challenging.

ERISA and Your Long-Term Disability Claim

ERISA, short for the Employee Retirement Income Security Act, covers most long-term disability insurance policies. This federal law often precedes state laws meant to safeguard consumers, presenting challenges for individuals seeking promised benefits. Our legal team is well-versed in navigating ERISA regulations, Department of Labor guidelines, plan documents, and federal court precedents.

If you have an individual disability insurance policy or are a church or government employee, ERISA does not govern your claim. Instead, state law does. Regardless of your policy type, we are committed to helping you obtain the benefits you deserve. If your claim has been denied, time is of the essence for filing an appeal. It is crucial to seek assistance promptly.

Common Mistakes People Make When Applying for Long-Term Disability Benefits

Some of the common mistakes people make when filing a claim for disability benefits are:

- Failing to provide sufficient medical documentation to support their claim

- Missing deadlines for submitting paperwork or appealing a denied claim

- Not seeking legal assistance when necessary

- Underestimating the complexity of the application process

Attorney Nick Ortiz discusses these and other common mistakes that could destroy your long-term disability claim in his free Top Ten Mistakes That Will DESTROY Your Long-Term Disability Claim eBook.

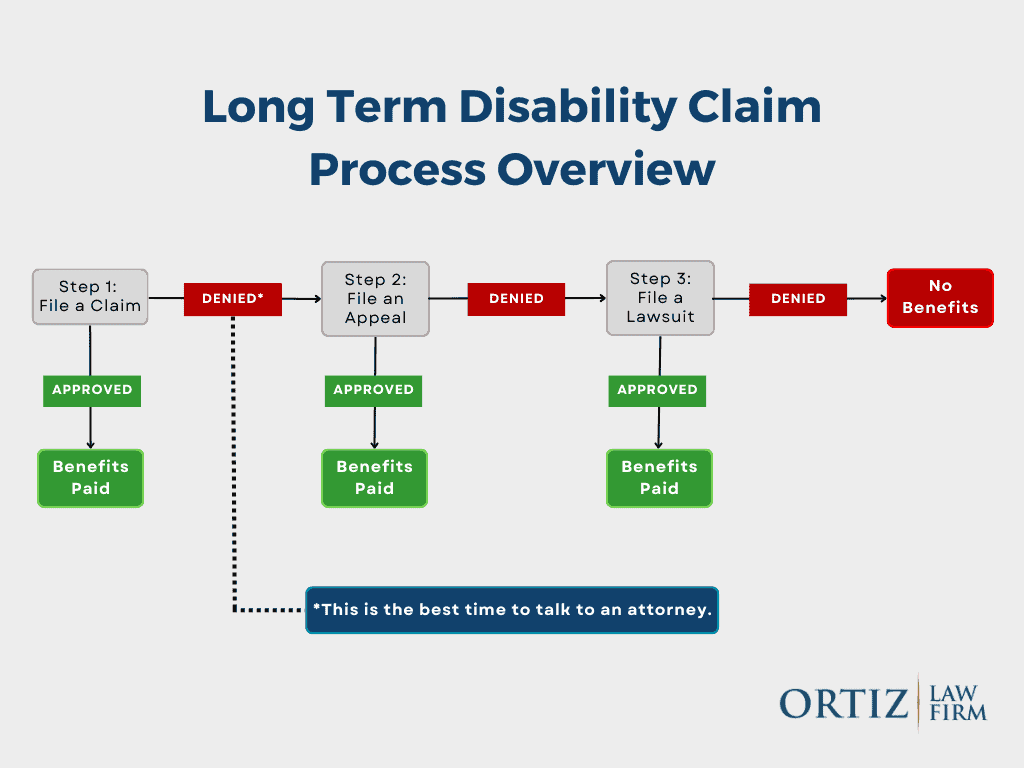

What to Do If Your Long-Term Disability Claim Is Denied

If your long-term disability claim is denied, you must file an appeal. Submitting additional medical evidence to support your appeal is essential. Insurance companies known for denying disability insurance claims include:

An attorney can explain your rights and options after an LTD denial and help you navigate the appeals process. They can also represent you in negotiations or legal action against your insurance carrier if necessary.

How Ortiz Law Firm Can Help with Your Long-Term Disability Claim

Our involvement in the long-term disability process typically begins in one of the following two stages:

- After a claim has been denied and the claimant needs to file an administrative appeal directly with the LTD insurance company.

- When all administrative appeals have been exhausted and the only option left is a lawsuit against the insurance company.

Long-Term Disability Administrative Appeals

Our office is most commonly contacted to help with the administrative appeal stage of the long-term disability claim process. We are familiar with the appeals process and can help you navigate its complex requirements and deadlines. We have a proven track record of successfully appealing denied claims and helping our clients receive the benefits they are entitled to.

Most claimants call us when either (a) the initial application/claim has been denied or (b) the claim has been wrongfully cut off (in other words, benefits have stopped). Oftentimes, benefits are terminated after two years when the disability insurance policy switches from evaluating the claim under an “own occupation” standard to an “any occupation” standard.

There are many reasons why an insurance company will terminate benefits. They may have discovered that you have missed doctors’ appointments and think you are no longer disabled as you require less medical treatment. They may put you under surveillance and think they have enough evidence to stop benefits. Your disability could be hard to prove with “objective medical testing,” such as depression and anxiety. The best thing to do is to allow our firm to help you navigate the appeal process.

The first thing to do is to contact our office to schedule your free case evaluation. During your free case evaluation, you will speak to a licensed attorney with substantial experience with long-term disability claims and appeals. There is no charge for this call. You will not be obligated to hire us. During the call, you can ask any questions regarding long-term disability, and we will answer them.

After discussing your situation, if we can help you and you have a case, we will move forward to signing a contingency fee contract. A contingency fee is not paid upfront. You will also need to sign an authorization form for us to obtain your claim file from the insurance company.

After you sign and return the contract and forms, we will contact the insurance company and request a copy of your claim or administrative files. Your administrative file contains all the information regarding your case, including medical reports, disability policy, claim notes, and correspondence between you and the insurance company. This is the only information to be reviewed if the claim goes to court, so it must be complete.

We have a “No Recovery, Zero Fee Guarantee.” This means our clients only pay an attorney fee when disability benefits are recovered.

After the insurance company receives our request, it takes three to four weeks for them to copy and send us your file. Once our team receives your file, we start working on inputting the information into our system. This process usually takes a week. After that, the attorney will review your claim and contact you to discuss your case. Our attorney will outline the strategy for an appeal, and you will provide your input. When you agree with the plan, we will start the appeal process.

The appeal plan can take up to 8-12 weeks, but sometimes longer (such as when we have trouble getting information from a doctor’s office, we are waiting for statements from your various doctors, or if the insurance company requests an independent medical examination). The appeal is then filed with the updated supporting documentation.

From that point, the insurance company has 45 days after receiving the appeal letter to decide. The insurance company can extend the decision process so long as there is a reason for the delay and they request it in writing. Your appeal will have one of two outcomes:

- The insurance company will approve your appeal, reinstate your benefits and pay all past-due benefits; or

- They will deny your claim again. If you have another appeal available, you may pursue a second appeal. If all appeals have been exhausted, we will file a lawsuit.

Long-Term Disability Lawsuits

In an ERISA disability claim, a lawsuit cannot be filed until all of the claimant’s administrative remedies have been exhausted. Most LTD policies governed by ERISA require at least one appeal with the insurance company or plan administrator before a lawsuit can be filed. A long-term disability attorney will:

- Prepare the lawsuit.

- Conduct additional discovery against the insurance company.

- Attend court appearances for status conferences with the judge.

- Engage in settlement negotiations during the lawsuit or mediation.

- Prepare for mediation.

- Prepare for trial.

- Prepare the exhibits, including medical records and physician opinions, for trial.

- Prepare and organize demonstrative exhibits for trial.

- Prepare briefs and pretrial motions to file with the court to eliminate surprises at trial.

- Take the case to trial, usually a bench trial with the judge, not a jury trial.

- Review and analyze the verdict to determine if either side has grounds to appeal the verdict.

- Recommend to the client whether or not to appeal the case.

The time it takes to get long-term disability benefits can vary depending on several factors, including the complexity of your case and the insurance company’s responsiveness. It can take several months or even years to receive benefits, and it’s essential to be patient and persistent throughout the process.

We aim to help you receive the financial support you need to cover essential expenses and support your recovery. We are here to provide the guidance and support you need to successfully navigate the long-term disability claim process and receive the benefits you deserve. To reiterate this point, your attorney does not get paid until you do so that you can proceed with your case without fear of upfront legal bills or costs. Although based in Florida, the Ortiz Law Firm represents claimants across the United States.

Why Ortiz Law Firm Handles Long-Term Disability Claims

Why You Should Hire the Ortiz Law Firm for Your Long-Term Disability Claim

The Ortiz Law Firm is dedicated to compassionate client service and outstanding results. Mr. Ortiz has represented long-term disability claimants nationwide since 2005. The Ortiz Law Firm is not a “mill” firm that will represent just anyone who calls. The Ortiz Law Firm accepts approximately one in ten applicants who request legal assistance. Mr. Ortiz has the support of several paralegals and an office manager, working together to deliver the highest level of legal representation.

Get Help with Your Long-Term Disability Claim

Navigating the long-term disability claim process can be overwhelming and stressful, especially if your claim is denied or terminated. Hiring a long-term disability attorney can not only reduce your stress and anxiety but can also increase the likelihood that your claim will be approved. When choosing an attorney, consider their experience, reputation, communication, and fee structure.

We are here to help you navigate the process and fight for your rights. If you’d like to speak to a Pensacola Long-Term Disability Insurance Attorney about your denied claim, call us to schedule a consultation. Call our office at (888) 321-8131 or complete our contact form today.

Frequently Asked Questions

What Is a Long-Term Disability Attorney?

A long-term disability attorney specializes in helping clients navigate the complex long-term disability claim process.

What Does a Long-Term Disability Attorney Do?

A long-term disability attorney will:

– Evaluate your disability claim and help you understand your rights and options.

– Gather and organize the necessary documentation to support your claim.

– Represent you in negotiations with the insurance company.

– Appeal a denied claim or pursue legal action on your behalf.

– Provide guidance and support throughout the entire claim process.

Do I Need an Attorney to Appeal a Denial of Long-Term Disability Benefits?

While you are not required to hire an attorney to appeal the denial of your long-term disability benefits, doing so can significantly increase your chances of getting approved and help ensure your rights are protected throughout the appeal process. If you intend to appeal independently, we encourage you to review our free, step-by-step disability insurance appeal guide.

When Should You Hire a Long-Term Disability Attorney?

If you struggle to get the disability benefits you deserve, you should consider hiring a long-term disability attorney. Some common situations where you might need an attorney include:

– Your long-term disability claim has been denied or terminated.

– Your employer is disputing your claim for long-term disability benefits.

– You have been receiving benefits but are now facing a review or termination.

– Your long-term disability appeal has been denied, and you must file suit.

How Do You Choose the Right Long-Term Disability Attorney?

Choosing the right long-term disability attorney is an important decision. Here are some factors to consider when selecting an attorney:

Experience: Look for an attorney with expertise in handling long-term disability claims with different insurance companies.

Reputation: Research the attorney’s reputation and track record of success.

Communication: Make sure the attorney is responsive and communicates clearly and effectively.

Fees: Understand the attorney’s fee structure and ensure it is reasonable and transparent.

How Much Does a Long-Term Disability Attorney Cost?

The cost of a long-term disability attorney can vary depending on several factors, including the complexity of your case, the attorney’s experience, and the fee structure. Some attorneys charge a flat fee or hourly rate, while others work on a contingency basis. A contingency fee means your attorney will only get paid if there is a recovery. Discussing fees with potential attorneys and ensuring you understand the fee structure before hiring is critical. At Ortiz Law Firm, we operate on a contingency fee basis.

What Are the Benefits of Hiring a Long-Term Disability Attorney?

There are many benefits to hiring a long-term disability attorney, including:

Advocacy: An attorney can serve as your advocate, ensuring that your rights are protected and your best interests are represented.

Expertise: A long-term disability attorney has specialized knowledge and expertise in disability law and can provide guidance and support throughout the claim process.

Increased Chances of Approval: A long-term disability attorney can help ensure your appeal is adequately supported and presented, increasing your chances of getting approved.

Reduced Stress: Dealing with a disability claim can be stressful and overwhelming. An attorney can handle the process for you, reducing your stress and allowing you to focus on your health and well-being.

What Are Some Resources for Finding a Long-Term Disability Attorney?

Some resources for finding a long-term disability attorney include referrals from friends or family members, state bar association referral services, online directories and reviews of attorneys, and disability advocacy groups.

What Is the Difference Between a Long-Term Disability Attorney and a Disability Advocate?

A long-term disability attorney is a licensed legal professional who can provide legal advice and representation. In contrast, a disability advocate is a non-attorney who can assist with the disability application process but cannot provide legal advice or represent you in court.

Don’t Give Up on the Benefits You Deserve

We’ve helped clients nationwide recover millions in denied disability benefits.